How can I pay stamp duty and registration online in Karnataka?

Answered on August 23,2021

Let me give you a real example that how I paid stamp duty and registration for a property in Karnataka.

My answer explains the government charge payments for both sale agreement and sale deed.

I was about to buy a property. It's a 3BHK flat and the buying price is Rs. 82 Lakh.

We collected the following documents from seller and submitted them to bank for verification.

-

Mother deed

-

Sale deed

-

Form15 encumbrance certificate

-

Tax paid receipt (current financial year)

-

Khata certificate and extract

Bank verified the document and confirmed us to proceed with sale agreement and frank the agreement 0.1% of buying price.

We prepared the sale agreement. Buyer, seller, and witnesses have signed the agreement.

As per the bank, we have to frank the sale agreement with 0.1% of buying price that is Rs, 8,200/-. We approached the sub-registrar office with our sale agreement, in my case Jayanagar sub-registrar office in Bangalore. The sub-registrar told us to generate the K2 challan of Rs. 8,200/- to frank the sale agreement

Below is the step-by-step procedure we followed to generate challan for sale agreement franking.

Step 1: Open the K2 website.

Step 2: Scroll down a bit and click on “Generate Challan”. Below image in the circle for your reference.

Step 3: Fill the application with relevant details. Below application image for your reference.

In below, we explained the step-by-step procedure to fill the application.

Step 4: Date: Date appears default, it doesn’t require an entry. Below image in the circle for your reference.

Step 5: Remitter Details: Enter your name, address, email id, and contact number. Below screenshot for your reference.

Step 6: In category, select “Government”. Below image in the circle for your reference.

Step 7: In District, select Bengaluru Urban or Bengaluru Rural. In my case, property is located in Bengaluru Urban so I selected Bengaluru Urban.

Below image in the circle for your reference.

Step 8: In Department, type “ Department of stamps and registration” (Just type the word stamps for auto pop of Department of stamps and registration for selection.

Refer to the below image in the circle.

Step 9:

In DDO office, select your sub-registrar office from drop-down list. In my case, it's Jayanagar sub-registrar office.

DDO code popup automatically. (no editing require)

Refer to the below image in the circles.

Step 10: In purpose, select “STAMP DUTY” from dropdown list.

Head of account popup automatically. (editing not require)

Step 11: In Sub purpose name, select “Agreement for sale of immoveable property [Article No.5(e)]”.

Refer to the below image in circle.

Step 12: In amount, type the value of stamp duty. In my case, the stamp duty for my sale agreement is Rs. 8,200/-

Refer to the below image in circle.

Step 13: Click on “add”. Refer to the below image.

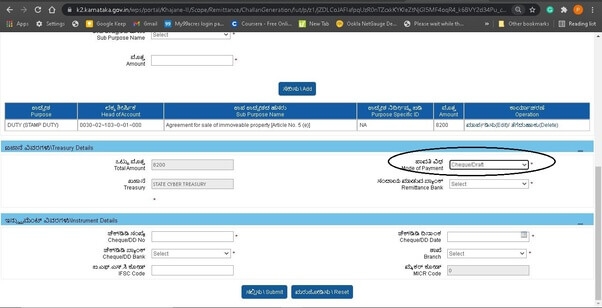

Step 14: Select mode of payment from the drop-down list. In my case, the mode of payment is demand draft. Selected Demand draft from dropdown list.

Refer to the circle in below image.

(Note: Online payment option is not applicable for stamp duty exceeding more than Rs. 2000/-. Stamp duty exceeding more than Rs. 2000 payable via cash, cheque, or demand draft.)

Step 15: In the remittance bank, select the bank where you will deposit cash, Cheque or Demand draft. In my case, I will be depositing demand draft in state bank of India so I selected “STATE BANK OF INDIA” from the drop-down list.

Step 16: In instrument details, enter the details of Demand draft. Below image for your reference.

Step 17: Click “Submit”. On next page, reconfirm your details. Refer to the below image.

Step 18: Type CAPTCHA and click on “Confirm”. Below image for your reference.

The challan number will be generated and below image for your reference.

It's important to note down the challan number or take a photo of it. (Once you lose the challan number, not able to track the challan so noting the challan number is important at this stage)

Step 19: Press “Ok”.

Challan generates. Below image for your reference.

The final PDF or printed challan looks like the below image

Step 20: We prepared the demand draft (DD) of Rs. 8,200/-. Below image for your reference.

Step 21: Submit the challan and DD to bank. Receive acknowledgment seal from bank.

Might take 3–4 days to clear the DD. To check the payment status, follow the below step

Step 22: Open the K2

Step 23: Scroll down a bit and click on “Verify Challan payment status”. Below image in circle for your reference.

Step 24: Enter challan number, captcha and click submit. Below image for your reference.

In the below image, “Payment received at agency bank”, it means that payment is successful.

Step 25: Carried the challan which is acknowledged by bank seal & sign and sale agreement to Sub-registrar office.

The sub-registrar cross-checked the payment status and franked my sale agreement. Below is the image of franked sale agreement

This completed the process to generate challan for sale agreement.

Let's look into the challan generation for sale deed.

As mentioned above, my buying price is Rs. 82 lakhs. Hence the following are my cost break for property registration.

Cess: 0.5% X 82,00,000 = 41,000

Stamp Duty: 5% X 82,00,000 = 4,10,000

Registration : 1% X 82,00,000 = 82,000

Scanning fee : Rs. 770 (Rs. 30 per page)

We have to generate challan for above figures. Below is the step-by-step procedure to generate challan.

Step 26: Open the K2 website.

Step 27: Scroll down a bit and click on “Generate Challan”. Below image in the circle for your reference.

Step 28: Fill the application with relevant details. Below application image for your reference.

In below, we explained the step-by-step procedure to fill the application.

Step 29: Date: Date appears default, it doesn’t require an entry. Below image in the circle for your reference.

Step 30: Remitter Details: Enter your name, address, email id, and contact number. Below screenshot for your reference.

Step 31: In category, select “Government”. Below image in the circle for your reference.

Step 32: In District, select Bengaluru Urban or Bengaluru Rural. In my case, it's Bengaluru Urban so I selected Bengaluru Urban.

Below image in the circle for your reference.

Step 33: In Department, type “ Department of stamps and registration” (Just type the word stamps for auto pop of Department of stamps and registration for selection).

Refer to the below image in the circle.

Step 34:

-

In DDO office, select your sub-registrar office from drop-down list. In my case, it's Jayanagar sub-registrar office.

-

DDO code popup automatically once after seleting sub-registrar office (no editing require)

Refer to the below image in the circles.

Step 35:

-

In Purpose, select “CESS ON STAMPS”

-

Head of account pop-up automatically (no editing require)

-

In Sub purpose Name, select “Fees for Registering Documents”.

-

Enter the CESS value, in my case, the cess is Rs. 41,000/-.

-

Click on “Add”. Refer to the below image.

Step 36:

-

In Purpose, select “DUTY (STAMP DUTY)” from dropdown list.

-

Head of account pop-up automatically (no editing require)

-

In Sub purpose Name, select “Sale/Conveyance of Flat/Apartment [Article No.20(2)]” in dropdown list for BBMP property

(Select “Sale/Conveyance of Flat/Apartment by BDA/KHB [Article No.20(3)]” in dropdown list for BDA and KHB property.)

-

Enter the stamp duty value, in my case, the stamp duty is Rs. 4,10,000/-.

-

Click on “Add” Refer to the below image in black rectangle.

Step 37:

-

In Purpose, select “FEES”

-

Head of account pop-up automatically (no editing require)

-

In Sub purpose Name, select “Fees for registering documents” from dropdown list.

-

Enter the fees value, in my case, the registration fee is Rs. 82,000/-.

-

Click on “Add”. Refer to the below image in black rectangle.

Step 38:

-

In Purpose, select “FEES FOR SUPPLY OF REGISTERED DOCUMENTS”

-

Head of account pop-up automatically (no editing require)

-

In Sub purpose Name, select “Scanning Fees” from dropdown list.

-

Enter the scanning fee, in my case, the scanning fee is Rs. 770/-.

-

Click on “Add”. Refer to the below image in black rectangle.

Step 39:

-

Enter the mode of payment, we selected “Cheque/Draft” as our payment option.

-

Enter your PAN or TAN Number

-

In Remittance Bank, select the bank name where you want to present the cheque or demand draft. In my case, we selected “STATE BANK OF INDIA”.

Refer to the below image in circle.

Step 40:

-

Enter the Cheque or Demand draft number

-

Enter date of cheque

-

Name of the Bank of cheque

-

IFSC and MICR code pop-up automatically

Refer to the below image in rectangular encircled.

Step 41: Click “Submit”. Refer to the below image in circle.

Step 42: Below is the image of filled application. Enter the CAPTCHA Code and submit the application.

Step 43: Note down the challan number and below challan image for your reference.

Click “OK”.

Step 44: The final printed challan looks like the below image.

Step 45: Present the cheque in any one of the following nominated bank.

Get the acknowledgement seal on challan aginst presenting the cheque.

- CANARA BANK

- CENTRAL BANK OF INDIA

- STATE BANK OF INDIA

- UNION BANK OF INDIA

Your cheque should be cleared in another 3–4 working days.

Follow the below step to check the payment status.

Step 46: Open the K2

Step 47: Scroll down a bit and click on “Verify Challan payment status”. Below image in circle for your reference.

Step 48: Enter challan number, captcha and click submit. Below image for your reference.

Step 49: Referring to the below image, the payment status shows “Success”

This completes the procedure to generate challan for property registration.

Note:

-

A challan is valid for 7 days from the day of challan generation. Hence complete the payment within 7 days of challan generation.

-

A challan is valid for 90 days from the day of payment. Hence register your property within 90 days from the day of payment completion. In case expires, it's cumbersome to claim refund.

-

As soon as you enter the sub-registrar office for sale deed registration. It is important to get your challan authenticated with sub-registrar sign to move further step for deed registration. (mainly the sub-registrar authenticates the payment success).

We provide assistance to generate challan & pay government charges. To opt for our service, please Whatsapp to + 9 1 - 9 7 4 2 4 7 9 0 2 0.

Thank you for reading…

Bhoomi RTC - Land Records in Karnataka

Bhoomi (meaning “land”) is an online portal for the management of land records in the state of Karnataka. Bhoomi portal provides the following information. Land owners..Click here to get a detailed guide

Karnataka Voter List 2024 - Search By Name, Download

Empowering citizens to exercise their democratic rights is crucial, especially in the vibrant state of Karnataka. This concise guide offers clear steps for downloading the voter list, searc..Click here to get a detailed guide

Share

Share

Clap

Clap

9447 views

9447 views

1

1 146

146