Is there any concession of the stamp duty in respect of gift deeds in favor of family members?

Answered on April 20,2022

Yes

The government charges are less in respect of gift deeds to family members

In Karnataka, following are the government charges of blood relatives

- Stamp Duty: Rs. 5150

- Registration fee Rs. 1000

- Cess: Rs. 500

- Scanning Fee Rs. 450

Following people come under blood relative category

- Father

- Mother

- Brother

- Sister

- Husband

- Wife

- Son/Daughter

Uncle, nephew, in-laws doesn't come under blood relative category

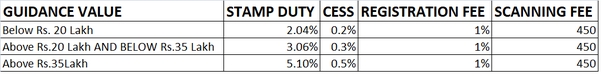

Following are the government charges of non-blood relative category: Below % is based on guidance value

- Every property in India has guidance value that is fixed by the revenue department of your locality, the guidance value is minimum amount for which a property can be registered in a particular locality and hence the property would not be registered for an amount lower than the guidance value

- Get the guidance value of your property in your area registrar's office.

- Guidance value, Government value and circle rate are referred to same

------------

In Bangalore, we provide end to end assistance to register Gift deed,

To opt for our service, please Whatsapp to +91-97424-79020.

Thank you for reading…

Chandana

ChandanaAnswered on December 23,2019

Yes, there is a concession. If a person in relation to the donor is husband, wife, son, daughter, daughter-in-law or grandchildren stamp duty payable under the schedule to Karnataka Stamp Act is Rs.1000. Additional stamp duty towards local bodies is Rs.1000 and additional stamp duty towards infrastructure development is Rs.50. Total duty payable is Rs.2050.

Share

Share

Clap

Clap

259 views

259 views

1

1 7611

7611