What is the stamp duty for gift deed registration in Karnataka?

Answered on April 19,2022

Government charges are different for blood and non-blood relative.

Blood relatives irrespective of property value

- Stamp Duty: Rs. 5150

- Registration fee: Rs. 1000

- Cess: Rs 500

- Scanning Rs. 450

Following people come under blood relative category

- Father

- Mother

- Brother

- Sister

- Husband

- Wife

- Son/Daughter

Uncle, cousin, nephew, in-laws doesn’t come under blood relative category.

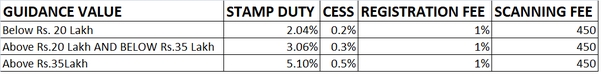

Non-blood relatives, the below % is based on guidance value.

Every property in India has guidance value that is fixed by the revenue department of your locality, the guidance value is minimum amount for which a property can be registered in a particular locality and hence the property would not be registered for an amount lower than the guidance value

Get the guidance value of your property in your area registrar's office.

------------------

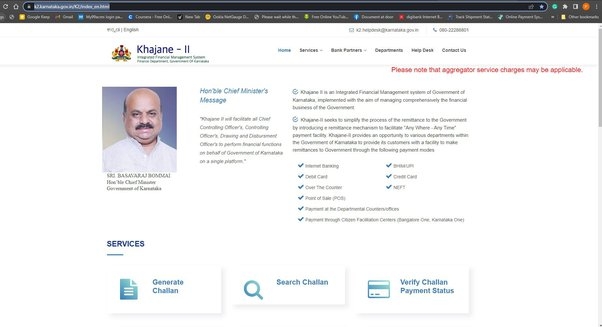

The government charges are paid on K2 website and generate K2 challan.

Below, we explained the detailed procedure to generate K2 challan.

Open the K2 website https://k2.karnataka.gov.in/K2/index_en.html

The home page looks like below

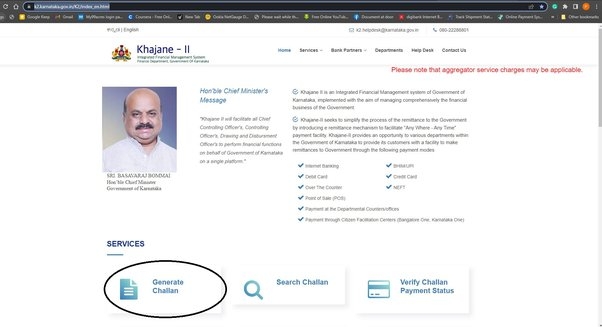

Click on Generate Challan, refer to below image in circle

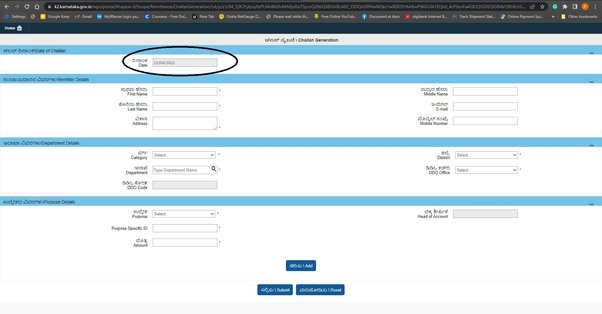

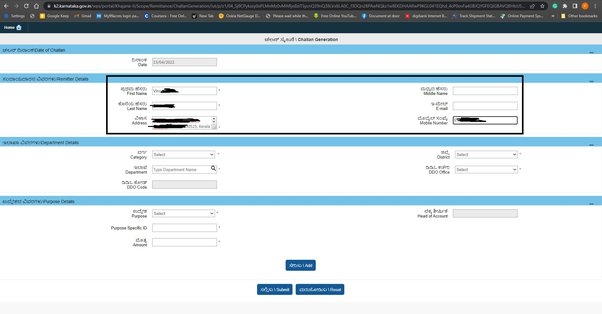

The current date shows by default, refer to below image

In Remitter Details, enter your personal information of Name, E-mail, Postal address, mobile number. Refer to below image,

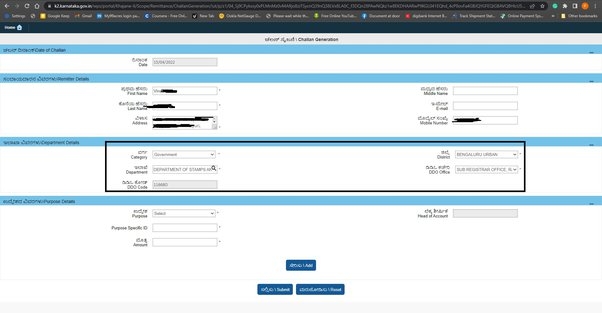

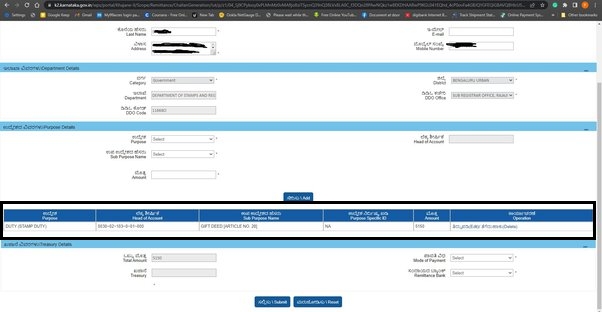

In Department Details:

- In Category, select Government from dropdown list

- In District, select your district from dropdown list, I selected BENGALURU URBAN as my district from dropdown list

- In Department, type DEPARTMENT OF STAMPS AND REGISTRATION

- In DDO Office, select your sub-registrar office from dropdown list. I selected Rajajinagar as my sub-registrar office. Refer to below image

- In DDO Code, popup automatically, no action requires

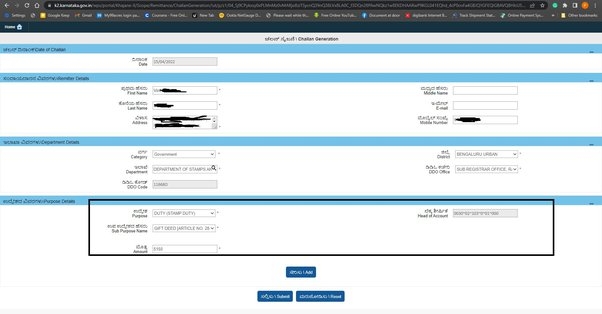

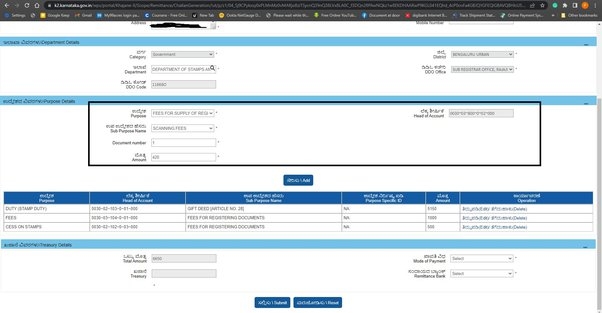

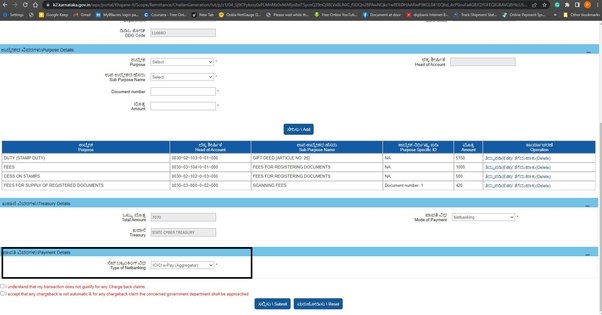

In Purpose Details,

- In Purpose, select DUTY (STAMP DUTY) from dropdown list

- In Sub Purpose Name, select GIFT DEED [ARTICLE NO.28] from dropdown list

- In Amount, type the stamp duty amount, I typed Rs. 5150.

- In Head of Account, popup automatically, no action requires. Refer to below image

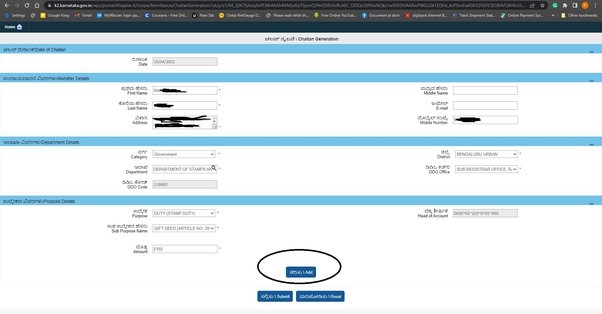

Click on “Add” refer to below image in circle

Stamp Duty indexes just below the Add button, refer to below image

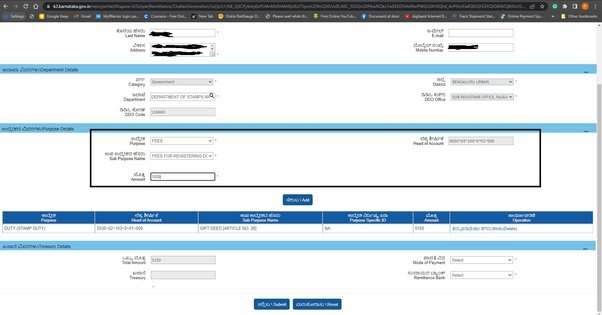

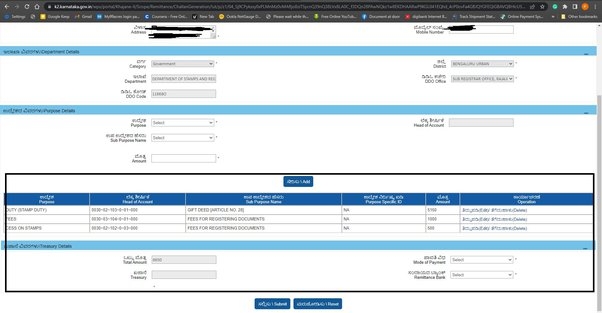

Again in Purpose Details

- In Purpose, select FEES from dropdown list

- In Sub Purpose Name, select FEES FOR REGISTERING DOCUMENTS from dropdown list

- In Amount, type the registration fee, I typed Rs. 1000.

- In Head of Account, popup automatically, no action requires. Refer to below image

Click on “Add”. Refer to below image in circle. (Registration fee indexed below the add button)

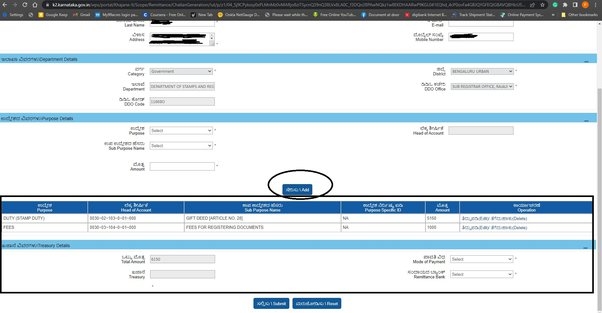

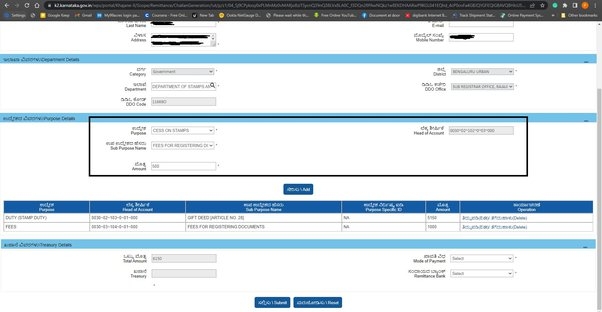

Again in Purpose Details

- In Purpose, select CESS ON STAMPS from dropdown list

- In Sub Purpose Name, select FEES FOR REGISTERING DOCUMENTS from dropdown list

- In Amount, type the cess amount, I typed Rs. 500.

- In Head of Account, popup automatically, no action requires. Refer to below image

Click on “Add”. Refer to below image (Cess is indexed below the add button)

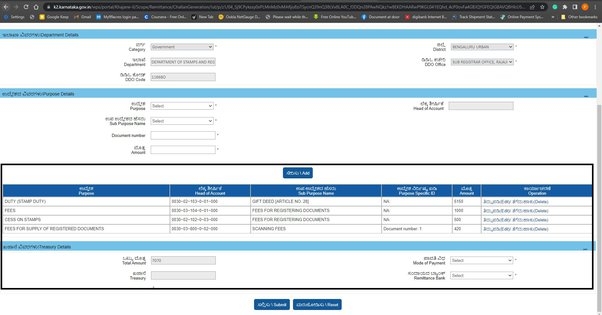

Again in Purpose Details

- In Purpose, select FEES FOR SUPPLY OF REGISTERED DOCUMENTS from dropdown list

- In Sub Purpose Name, select SCANNING FEES from dropdown list

- In Document number, type 1

- In Amount, type the scanning amount, I typed Rs. 420.

- In Head of Account, popup automatically, no action requires. Refer to below image

Click on “Add”. refer to below image (Scanning fee indexed below the add button)

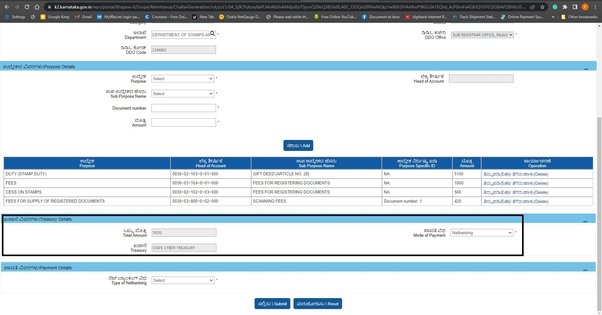

In Treasury Details:

- In Total Amount, totals automatically, no entry requires

- In Mode of Payment, select your payment mode. you have options to pay by cash, cheque/Draft, Debit card/ Credit card, NEFT/RTGS, or Netbanking. I selected netbanking as my payment mode from dropdown list.

- In Treasury, popup automatically, no entry requires. Refer to below image

In Payment Details:

In Type of Netbanking, you have option to pay directly through your integrated bank or through SBI e-Pay (Aggregator) or ICICI e-Pay (Aggregator).

I hold bank account in DBS Bank, my bank is not directly integrated on K2 website so I selected ICICI e-Pay (Aggregator) from dropdown list as my payment option. Refer to below image

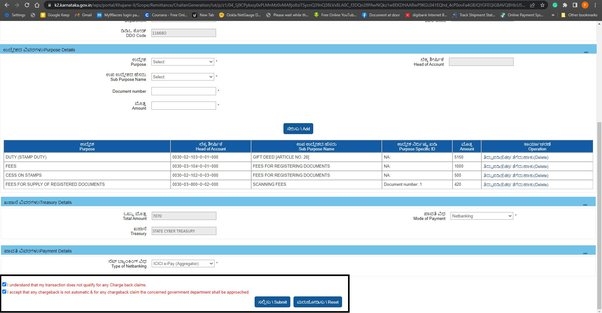

Read the terms & conditions mentioned in red color text and accept the same by clicking on the box.

Click on “Submit”. Refer to below image

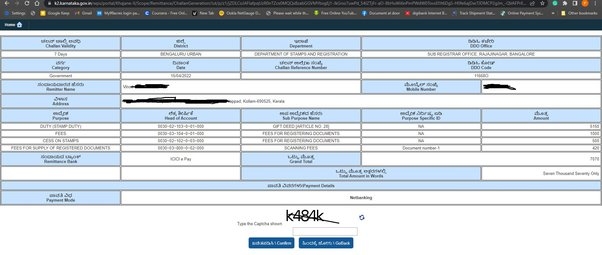

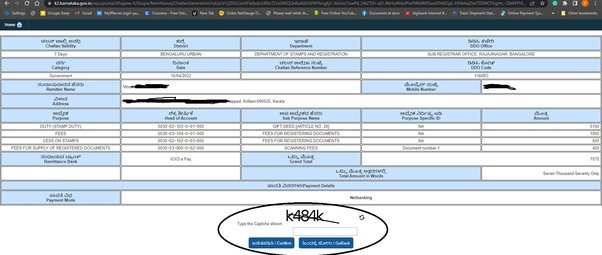

The summary report generates, refer to below image

Enter the Captcha shown and click on “Confirm”.

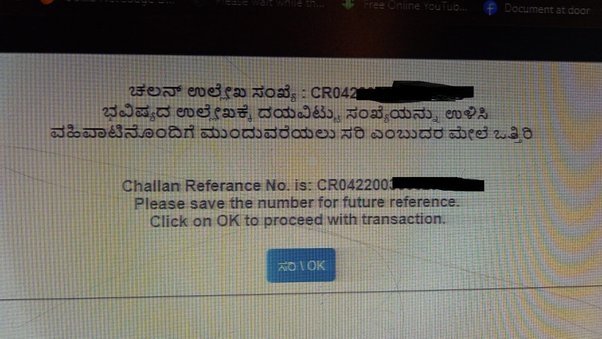

Challan Reference number generates. refer to below image

Click on “OK”.

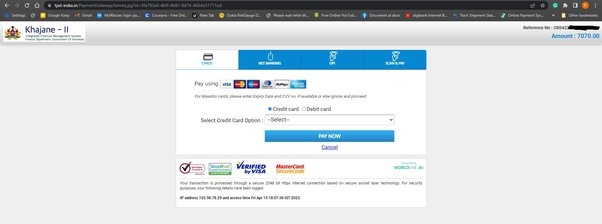

Directs to payment page, refer to below image

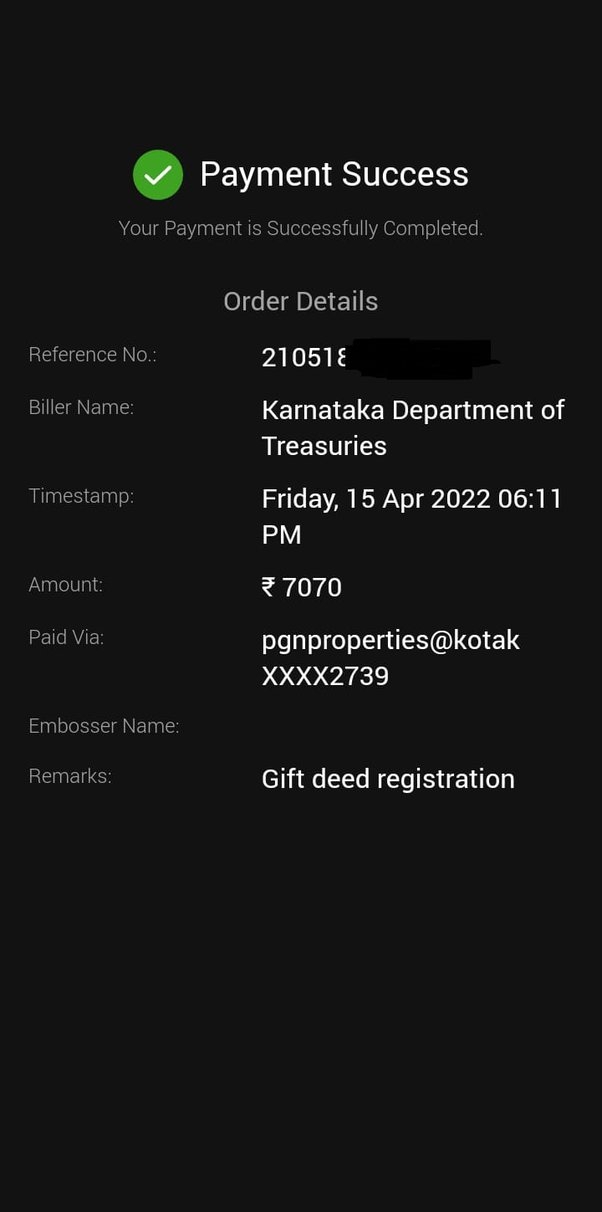

Made the payment through UPI. Below payment screenshot for your reference

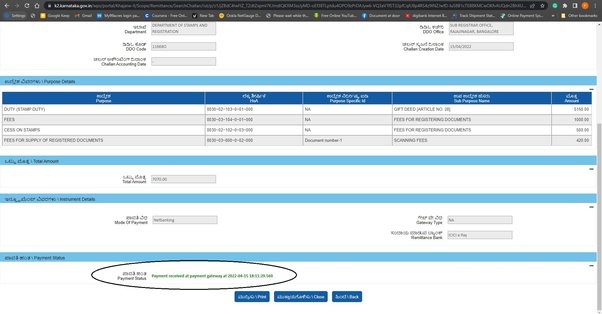

The page directs to payment status, refer to below image in circle

Click on “Print”.

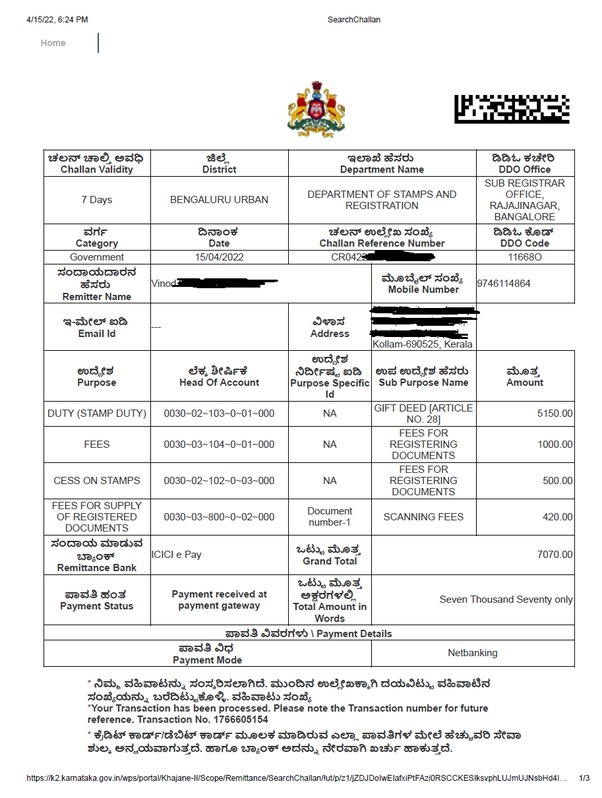

The K2 challan generates, refer to below image

Note:

- A challan is valid for 7 days from the day of challan generation, hence complete the payment within 7 days from day of challan generation

- A challan is valid for 90 days from the day of payment hence complete the gift deed registration within 90 days from the day of payment. Make sure that you complete the registration within 90 days or it would be cumbersome to claim refund.

-------------

We provide end-to-end assistance to register gift deed.

To opt for our service, please whatsapp to +91-97424-79020.

Thank you for reading…

Karnataka Voter List 2024 - Search By Name, Download

Empowering citizens to exercise their democratic rights is crucial, especially in the vibrant state of Karnataka. This concise guide offers clear steps for downloading the voter list, searc..Click here to get a detailed guide

Share

Share

Clap

Clap

11081 views

11081 views

1

1 1951

1951