Swavalambi Sarathi Scheme

- Sections

- Eligibility Criteria for Swavalambi Sarathi Scheme

- Documents Required for Swavalambi Sarathi Scheme

- Reservation under Swavalambi Sarathi Scheme

- Subsidy Under Swavalambi Sarathi Scheme

- How to Apply for Swavalambi Sarathi Scheme?

- How to Repay Loan for Swavalambi Sarathi Scheme?

- Additional Instructions for Swavalambi Sarathi Scheme

- References

- FAQs

Under Swavalambi Sarathi Scheme, subsidy of 50% on Vehicle value or up to a maximum of Rs. 3,00,000/- will be given to each beneficiary to buy Taxi/Goods Vehicles, and upto a maximum of Rs. 75,000/- will be given to buy Passenger Auto Rickshaw. The remaining amount of the vehicle if availed by the bank loan, the bank letter must be submitted.

|

The objective of the Swavalambi Sarathi Scheme is to provide subsidy from the Corporations to the unemployed youth belonging to Backward Classes Category-1, 2A, 3A and 3B for purchase of four wheeler light vehicles. |

Eligibility Criteria for Swavalambi Sarathi Scheme

Following are the eligibility criteria for swavalambi sarathi scheme.

-

Applicants should belong to religious minorities communities as defined in the Government Order.

-

Applicants should be permanent residents of Karnataka.

-

Age limit should be between 18 to 55 years.

-

Annual family income of the applicant from all sources should be below Rs. 6,00,000/-.

-

Applicants should have a valid Driving License issued by the Regional Transport Officer.

-

Any member of the applicant's family should not be a Central/State Government employee.

-

Applicant or his/her family members should not have availed benefits under any other scheme (Excluding Arivu Scheme) of the KMDCL in the last 5 years.

Documents Required for Swavalambi Sarathi Scheme

Following documents are required for swavalambi sarathi scheme

-

Income Certificate Issued by the competent authority

-

Copy of Aadhaar as Residential Proof

-

Copy Of Driving License

-

Copy of Bank Passbook

-

Copy of Vehicle Quotation

-

Caste/Minority Certificate Issued by the competent authority

-

Self-Declaration Form

-

A recent passport size photograph of the applicant.

Reservation under Swavalambi Sarathi Scheme

In this scheme, D. Devaraja Government has reserved 85% for Category-1 and 2A and 15% for Category-3A and 3B from the Backward Classes Development Corporation. In other corporations, all the communities covered by the respective corporation should be represented.

Subsidy Under Swavalambi Sarathi Scheme

50% subsidy on loan sanctioned by Nationalized Bank/Rural Banks or up to a maximum of Rs.3.00 lakhs whichever is less will be sanctioned by the Corporation for purchase of four wheelers under Swavalambi Sarathi Yojana. For a bank share loan, the loan amount has to be repaid in fixed installments with interest at the prevailing rate fixed by the bank.

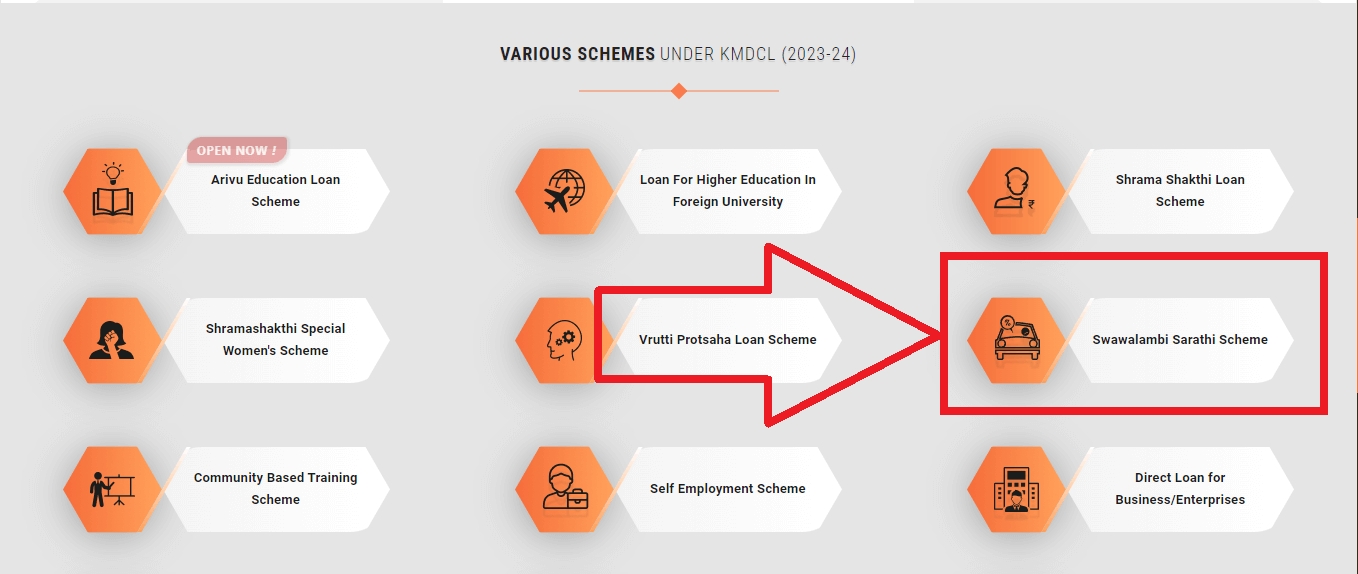

How to Apply for Swavalambi Sarathi Scheme?

Follow the below steps to apply for Swavalambi Sarathi Scheme.

-

Visit the KMDC Karnataka Portal.

-

Click on ‘E-Services’ under ‘Online Application’.

-

Select ‘Swavalambi Sarathi Scheme’ from the various schemes given.

-

Click on ‘Apply Online’.

-

Enter your mobile number.

-

You will receive an OTP on the entered mobile number. Enter the OTP.

-

An application form will open on your screen.

-

Fill the application form.

-

Upload the required documents.

-

Click on ‘Submit’.

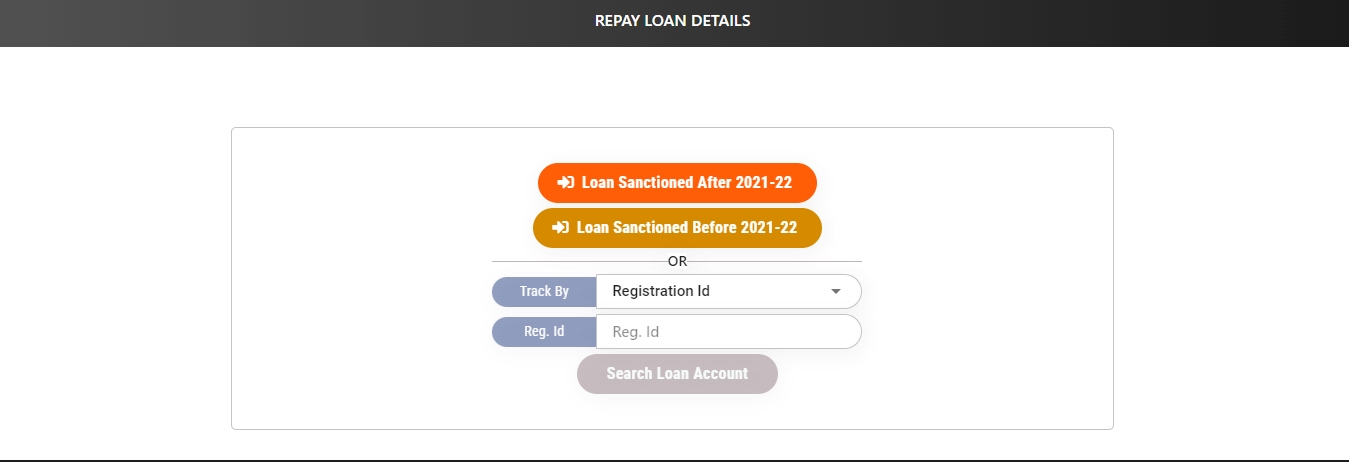

How to Repay Loan for Swavalambi Sarathi Scheme?

Follow the below steps to repay loan for swavalambi sarathi scheme.

-

Visit the KMDC Karnataka Portal.

-

Click on ‘E-Services’ under ‘Online Application’.

-

Click on ‘Repay Loan’.

-

Select loan details.

-

Select the year loan sanction.

-

Loan Sanctioned after 2021-22

-

Loan Sanctioned before 2021-22

-

You can also search your loan account by entering the registration id/mobile number.

- Click on ‘Search Loan Account’.

Additional Instructions for Swavalambi Sarathi Scheme

Following are some additional instructions for Swavalambi Sarathi Scheme

-

This Scheme is implemented by the corporation in collaboration with nationalized / Scheduled banks.

-

Those beneficiaries who are sanctioned / approved for loan from the Banks for the purchase of Passenger Auto Rickshaw / Goods Vehicle / Taxi will be provided a subsidy of 50% of the value of the vehicle or a maximum subsidy of Rs. 3.00 Lakhs.

-

Women will be given priority.

-

The vehicle purchased under this scheme should not be sold to others during the tenure of the loan.

-

Beneficiaries should submit information to KMDC District Office about the road tax and insurance along with supporting documents.

-

If any insurance payment is claimed, the insurance payment details should be shared to the corporation.

-

Beneficiaries should contribute 10% of the cost of the vehicle.

-

The vehicle subsidized through KMDC shall be displayed on the vehicle as "Subsidized by KMDC".

-

The District Manager should certify the “photo of the beneficiary along with the subsidized vehicle” in the file.

-

Permits are mandatory for passenger auto rickshaws in urban areas.

References

While crafting this guide, we have consulted reliable and authoritative sources, including official government directives, user manuals, and pertinent content sourced from government websites.

FAQs

You can find a list of common Karnataka Government Schemes queries and their answer in the link below.

Karnataka Government Schemes queries and its answers

Tesz is a free-to-use platform for citizens to ask government-related queries. Questions are sent to a community of experts, departments and citizens to answer. You can ask the queries here.

Ask Question

Share

Share